boulder co sales tax efile

Annual returns are due January 20. Sales tax is a tax collected on all retail transactions.

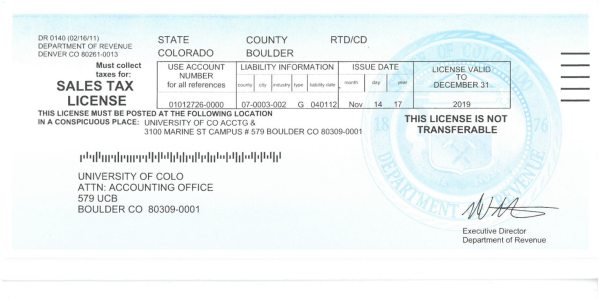

Sales Tax Campus Controller S Office University Of Colorado Boulder

FinanceSales Tax Licensing 303 335-4570.

. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. E-File Your Taxes Online. Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes.

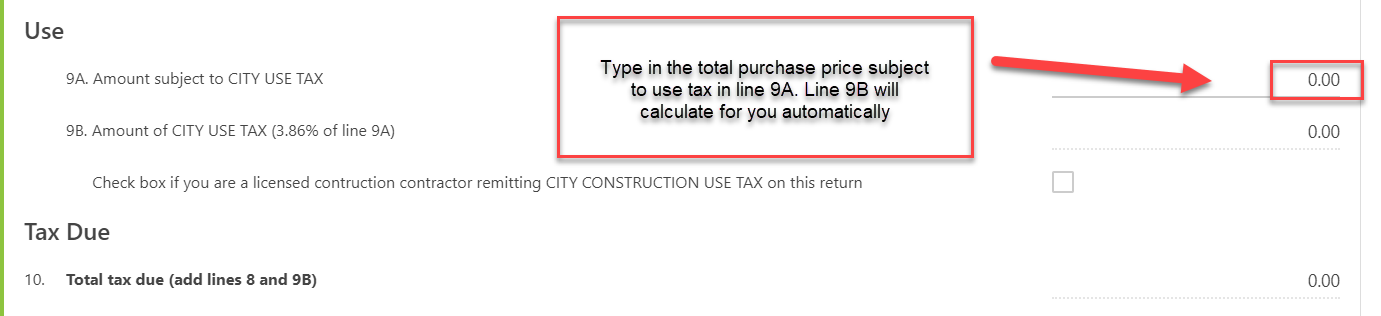

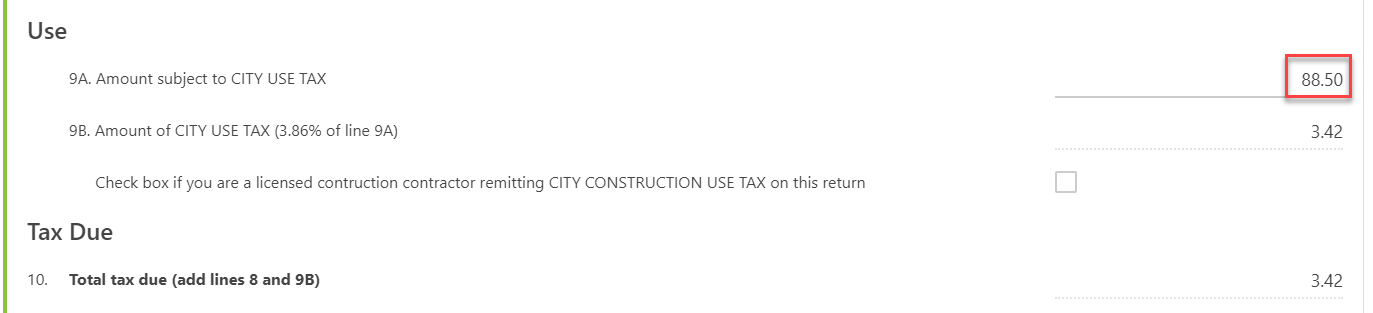

The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. Colorado has recent rate changes Fri Jan 01 2021. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides.

Sales tax returns may be filed quarterly. FinanceSales Tax Licensing 303 335-4524. Boulder County collects on average 057 of a propertys assessed fair market value as property tax.

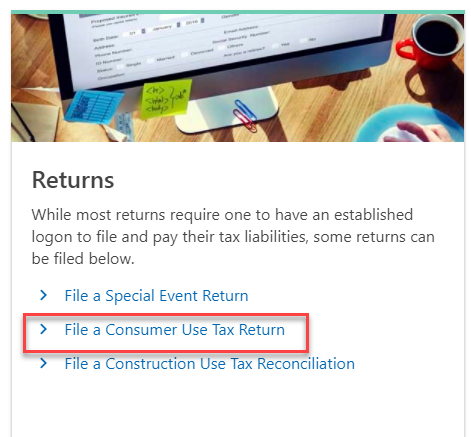

There are approximately 87879 people living in the Boulder area. Contact support if you are having trouble accessing your account applying for a license filing tax forms making payments or if you want to close your account. Electronically file and pay your current or prior sales and use tax return E-500 using our online filing and payment system.

80301 80302 80303 80304 80305 80306 80307 80308 80309 80310 and 80314. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. There is a one-time processing fee of 25 which may be paid by cash or check.

Information about City of Boulder Sales and Use Tax. The County sales tax rate is. If you have more than one business location you must file a separate return in Revenue Online for each location.

Boulder Online Tax System. 6 rows City SalesUse Taxes. Please visit the Colorado Department of Revenue website for more information or for required forms.

There are a few ways to e-file sales tax returns. Phone and web support at 1-888-751-1911. E-File Today Get Your Tax Refund.

Sales tax returns may be filed annually. Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. Online sales tax license application and filing.

This table shows the total sales tax rates for all cities and towns in. This is the total of state county and city sales tax rates. If you need additional assistance please call 303-441-3050 or e-mail us at.

Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. Citizen Access Online CA Broomfield vendors save time postage and cost by applying for sales tax licenses and filing sales tax returns pay by ACH Debit through CAPlease click the following links for more info. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Under 300 per month. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov. Colorado CO Sales Tax Rates by City A The state sales tax rate in Colorado is 2900.

For additional e-file options for businesses with more than one location see Using an. The Boulder Colorado sales tax rate of 8845 applies to the following eleven zip codes. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. MUNIRevs provides phone and web support Monday-Friday from 8am to 5pm. 15 or less per month.

Boulder County has one of the highest median property taxes in the United States and is ranked 437th of the 3143 counties in order of median property taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates. You also can visit the Sales Tax Office in the Longmont.

The median property tax in Boulder County Colorado is 2014 per year for a home worth the median value of 353300. The Colorado sales tax rate is currently. Filing frequency is determined by the amount of sales tax collected monthly.

The Boulder sales tax rate is. EFile and Pay Your Sales and Use Tax. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670.

Return the completed form in person 8-5 M-F or by mail. An alternative sales tax rate of 8855 applies in the tax region Lafayette which appertains to zip code 80301. FinanceSales Tax Licensing 303 335-4514.

If your sales and use tax filing frequency changed effective October 1 2021 you may see an incorrect period for your September return online. With local taxes the total sales tax rate is between 2900 and 11200. The Boulder Sales Tax is collected by the merchant on all qualifying sales.

You may also contact them via phone. As a statutory Town the Town of Eries sales tax is collected by the State of Colorado.

Construction Use Tax City Of Boulder

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Sales And Use Tax City Of Boulder

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Slow Tax Refunds Blamed For Taking Bite Out Of Restaurant Sales The Denver Post

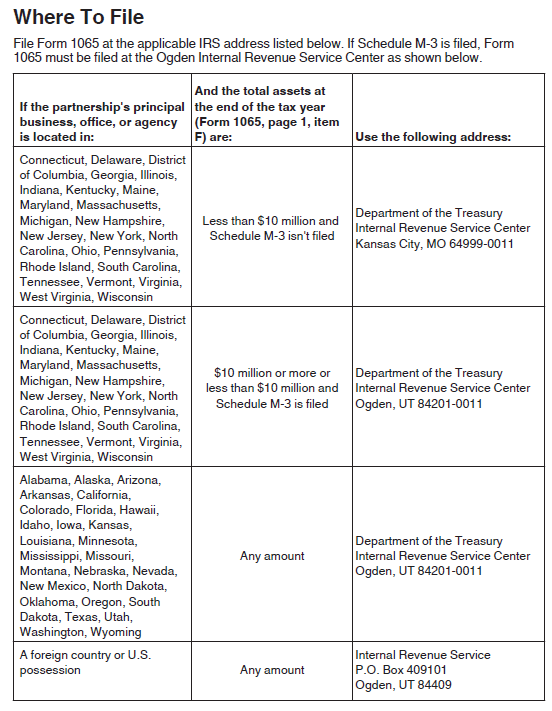

Filing Your Investment Club Taxes Bivio Investment Clubs

Sales Tax Campus Controller S Office University Of Colorado Boulder